27th May 2020

Results from our Crew Financial Wellbeing Survey

We conducted the first-ever Superyacht Crew Financial Wellbeing Survey to discover how crew feel about their finances. We asked questions related to savings and pensions as well as other important issues such as maternity leave.

Responses came from a range of Superyacht crew, from captains to deck hands. Of those who replied, 40% hold senior roles and 55% junior positions. The remaining 5% chose not to share this information. Respondents include United Advisers Marine (UAM) clients and those who are not. As a result, responses are more representative of the Superyacht industry as a whole. Where there was a large difference in responses, we have included a breakdown of the comparative results for UAM clients. You can download the full results as a PDF.

Key Finance survey findings

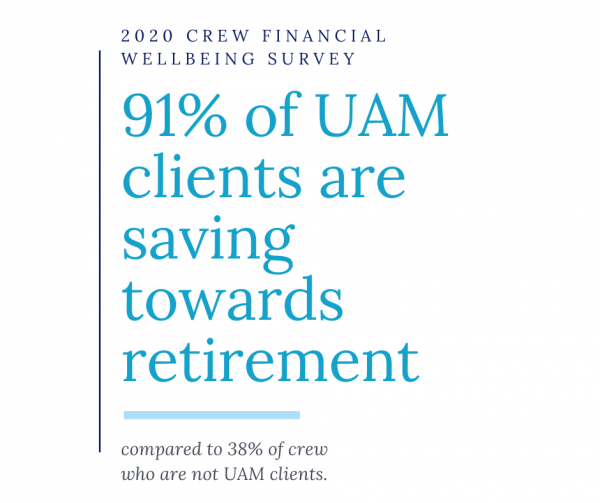

The broad base of respondents helped us better understand crew needs and concerns during different points in their careers. Some results didn’t surprise us, such as the large shortfall in retirement savings (only 6% of respondents said their employers make pension contributions). However, it shows how vital it is for crew to take charge of their finances sooner rather than later.

Other key findings include:

- More than half of all respondents lack the financial freedom to leave yachting at a time that suits them.

- There is not enough support for maternity leave across the yachting industry.

- Most crew feel a responsibility to educate themselves when it comes to finances.

- Standard Bank remains a popular choice for crew but online banks are quickly gaining popularity.

The survey results are covered in detail below, grouped under the following themes:

- savings and pensions

- financial freedom

- support for maternity leave

- financial education.

Savings and pensions

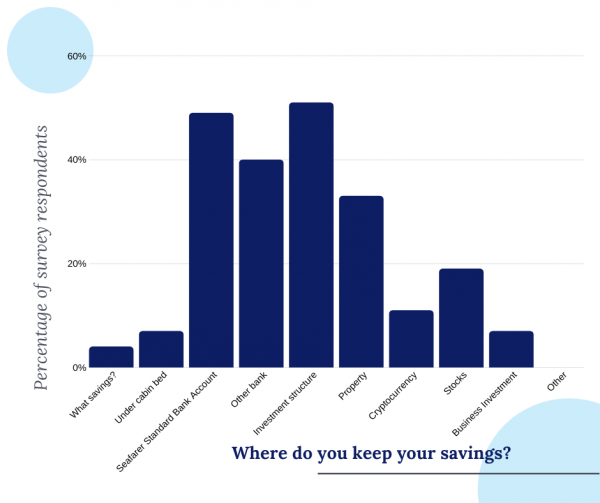

Where are crew keeping their savings?

Close to half of all respondents have savings in investments managed by third parties. This isn’t surprising given the aim of such investments is to achieve above-inflation returns, especially in the medium to long-term (5–10+ years). Below is the split between UAM clients and non-clients. Naturally there is a gap between our client base and other respondents as we work with crew to develop medium to long-term savings plans.

Bank accounts

A large number of yacht crew – especially those just starting out in the industry – opt for a Standard Bank Seafarers Account. Standard Bank remains the preferred banking option even though online banks are increasing in popularity. Whatever you decide, it’s important to get the right bank account for your needs. Again, there was a noticeable difference in results from our clients due to the number of crew we help open Standard Bank Accounts. It’s often the first thing we do for them once they become clients.

Property

Property is often touted as one of the best investments you can make. It’s therefore not surprising to see it rank as the fourth most popular savings vehicle after managed investment, Standard Bank accounts and other bank accounts. There are definite benefits to owning property and a certain comfort in knowing you’re a homeowner. It’s also a tangible investment: you can see and touch property, which makes it more attractive. Along with the benefits there are risks, so our advice is always to weigh up whether property is the best investment for you and your circumstances.

Under the bed

A few respondents admitted to keeping their savings under their cabin bed. Of course, we strongly advise against doing that (if only to get a better night’s sleep!).

Are employers contributing to pensions?

In response to whether employers contribute to an individual’s pension, only 6% of all respondents answered ‘yes’. That figure is low when compared to other industries, especially those based onshore.

There is a marked difference in opinion about who is responsible for paying pension contributions. Many think it’s only fair employers make some contribution while others believe it’s up to the individual.

The differences in attitude could be attributed to a crew member’s nationality and/or the flag state of the vessel on which they work; however, there’s no hard-and-fast rule that explains the difference.

What we do know from speaking with crew is that many don’t feel supported enough when saving towards their retirement. As a result, they often worry about their financial future.

Our advice is that when taking on a new role, talk about possible pension contributions with your employer. You won’t know what’s possible until you start the conversation.

Financial freedom

In response to the question ‘Do you have the financial freedom to leave yachting when it suits you?’, more than 60% of all participants responded ‘no’.

Put another way, only 37% of all crew surveyed feel as though they have enough financial independence to choose to leave yachting. This is why the term “golden handcuffs” is commonly used in the industry. The roles and opportunities the industry provides are fantastic but they can feel like a trap. Many crew end up returning to the industry because of financial constraints rather than their passion for their role. Financial freedom is about having the possibility to leave the industry (or not). It’s about making decisions on your terms rather than being forced to because of financial circumstances.

Very few crew are holding high levels of debt, which is a positive. Debt can be a financial weight and should always be the first priority in financial planning.

Unsurprisingly, not having enough money for retirement is a top concern. Given high wages and low living expenses while onboard, crew are in a position to contribute monthly to a savings plan. Such a plan could be used to fund your retirement.

After learning how to manage your money and track your spending, set some financial goals. Think about setting goals related specifically to your circumstances and build a savings plan.

The sooner you learn to be disciplined about your spending habits and commit to saving, the sooner you will have the financial freedom to make decisions about your future.

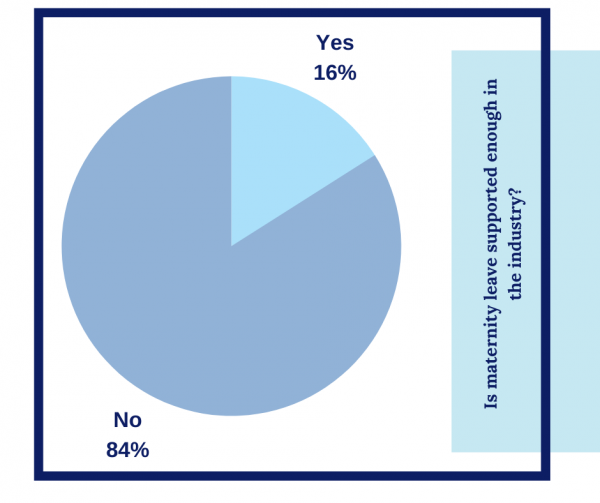

Maternity leave

We asked a question directly related to maternity leave because we’re aware of how it impacts a growing number of crew right across the industry.

We asked: ‘Is maternity leave supported enough in the industry?’

The answer we received was this:

Some respondents go so far as to say there is ‘zero support’ for maternity leave. Because of MLC regulations, some female crew even hide their pregnancies to stay employed longer, leading to safety concerns and fears about job security. The results are backed by anecdotes we hear indicating this is a real issue that’s having an increasing impact, especially on senior crew who don’t feel financially supported in their desire to start a family.

This brings to the fore that financial wellbeing of crew includes a whole range of factors, not just those related to salaries and savings. After all, wellbeing is the experience of health and happiness. If women in yachting are still having to choose between a career and starting a family, is that fair to their wellbeing?

The issue of maternity leave is still seen as a difficult topic, with little to no financial assistance offered to female yacht crew who fall pregnant. Our survey results show that an increasing number of crew see the need for more support for maternity leave.

A number of respondents believe maternity leave should be included in contracts to bring the industry in line with onshore industries that make such provisions. There were also suggestions for more rotational positions, especially for senior crew and heads of department, to allow female crew members to take time away to start a family and return to their positions afterwards.

This topic is outside our expertise; however, the Maritime & Coastguard Agency (MCA) provides some practical insight on the protection of new and expectant mothers at sea with their Marine Guidance Note 522 (MGN 522), in which there is a reference to maternity benefits. Although this is a guidance note to UK-flagged or UK-based vessels, many flag states base their regulations on those of the UK.

What our survey has highlighted is that constructive debate about paid maternity leave for crew on all yachts regardless of flag state is still missing within the industry.

Encouragingly, groups such as She of the Sea are shining a light on gender issues in yachting. While their work is focused on raising visibility and awareness of the opportunities for women, they are using their platform for industry-wide action on issues that affect yacht crew, including maternity leave.

Financial education

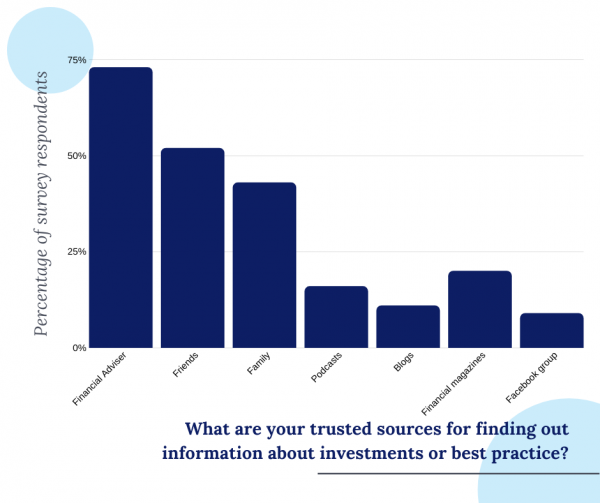

Credibility of financial advice is important, yet peer advice is popular

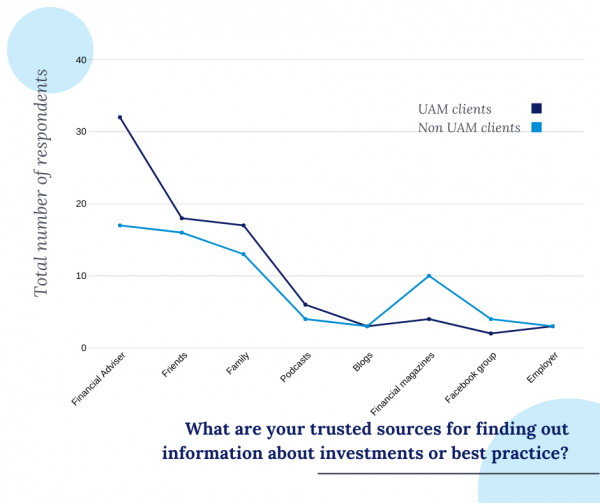

One of the final questions in our Crew Financial Wellbeing Survey was: ‘What are your trusted sources for finding information about investments or best practice?’.

Here are the overall results:

And here are the results split between UAM clients and other yacht crew:

The most trusted sources are financial advisers and financial magazines (despite the old adage that ‘print is dead’!). Credibility, therefore, is important to yacht crew when it comes to finding sources of information about managing money, building savings and making investments.

Seeking advice from peers is also popular amongst crew, especially when it comes to Standard Bank accounts and the Seafarers Earnings Deduction. This isn’t surprising given the amount of time crew spend living and working together.

We do advise caution, however, when it comes to making decisions about investments. Deciding where to invest should always be aligned to your individual circumstances and financial goals. What is right for one person may not be right for another.

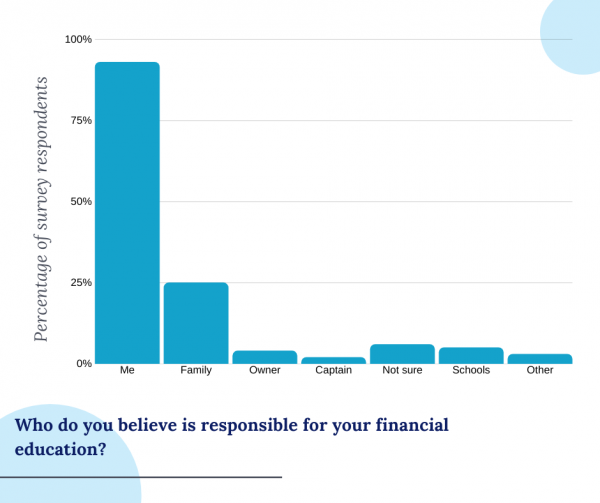

Crew take responsibility for their financial education

Close to 90% of all respondents believe they are responsible for their own financial education. As a result, more and more crew are carrying out their own research and are looking to take control of their finances. This is encouraging because when you take money seriously and start investing you have more choice about your financial future.

Financial wellbeing is about feeling as though you have enough money to meet your needs, now and in the future. It’s about having a sense of security. Being in control of your finances and having the financial freedom to make choices that allow you to enjoy your life results in a strong financial wellbeing.

If you are interested in educating yourself further, watch the replay of our Financial Awareness workshop or check out our financial planning resources especially for crew.

But we would never expect you to go it completely alone. Our team has decades of combined experience helping yacht crew develop personal financial plans.

If you’re keen to know more, don’t hesitate to get in touch.