29th Feb 2024

Seize the Moment: Secure Lucrative Returns Before a Likely Fall in Interest Rates

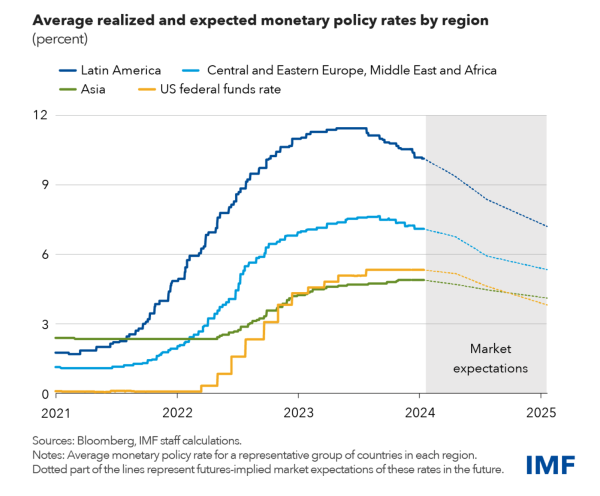

The investment landscape in 2023 showcased a promising outlook, with several economic indicators pointing towards a recovering market. Notably, the inflation rate began its descent, offering a positive trajectory for the financial sector. Concurrently, interest rates started to show signs of decline, a move closely monitored by central banks worldwide. The Bank of England’s Governor, Andrew Bailey, underscored the ongoing battle against inflation, reinforcing the bank’s commitment to stabilising it at a 2% per annum benchmark.

While global economic dynamics were shaping up, other challenges persisted. China grappled with a sluggish property market, evidenced by the sustained downturn in new home prices. However, with China’s growth target hovering around 5% per annum, a bounce-back from last year’s lockdown-induced lows was anticipated. Most homeowners have increased costs in recent years as interest rates as well as bills and insurance rates have gone up.

According to ESMA markets are expected to stay on edge, with ongoing risks of corrections due to geopolitical and macro-financial uncertainties. Christine Lagarde expressed concern that market expectations for an ECB rate cut this spring were counterproductive in combating inflation. “We’ve likely hit the peak in interest rates unless there’s another significant shock,” she remarked to the Financial Times. Lagarde continued to advocate that a restrictive stance is needed to drive inflation down. Rushing into rate cuts could potentially lead to further increases later.

Amidst this economic backdrop, Godwin Capital (GC), the investment arm of the UK-centric property development entity, Godwin Group, emerges as a beacon for potential investors. As interest rates are projected to decline, there exists a window of opportunity to harness high-returns— a window that Godwin, with its impeccable record of timely payments, offers to investors. GC prudently curates its investment portfolio, blending lower and higher yielding assets across varied maturity periods to maximise value and returns. Leveraging its robust network, Godwin establishes pre-land acquisition agreements with notable entities, from housing associations to renowned retailers like McDonald’s, Cosco, Lidl and Starbucks- just to name but a few.

For investors seeking avenues insulated from market volatilities, Godwin Capital’s proposition stands out. With a two-year loan note option, investors can opt for either a biannual 10% per annum coupon or a deferred 12% per annum gross rate, presenting a timely opportunity to lock in lucrative rates.

This communication is for informational purposes only and is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice from a professional adviser before embarking on any financial planning activity.