27th Mar 2019

Tips for money management when the ZAR is unstable

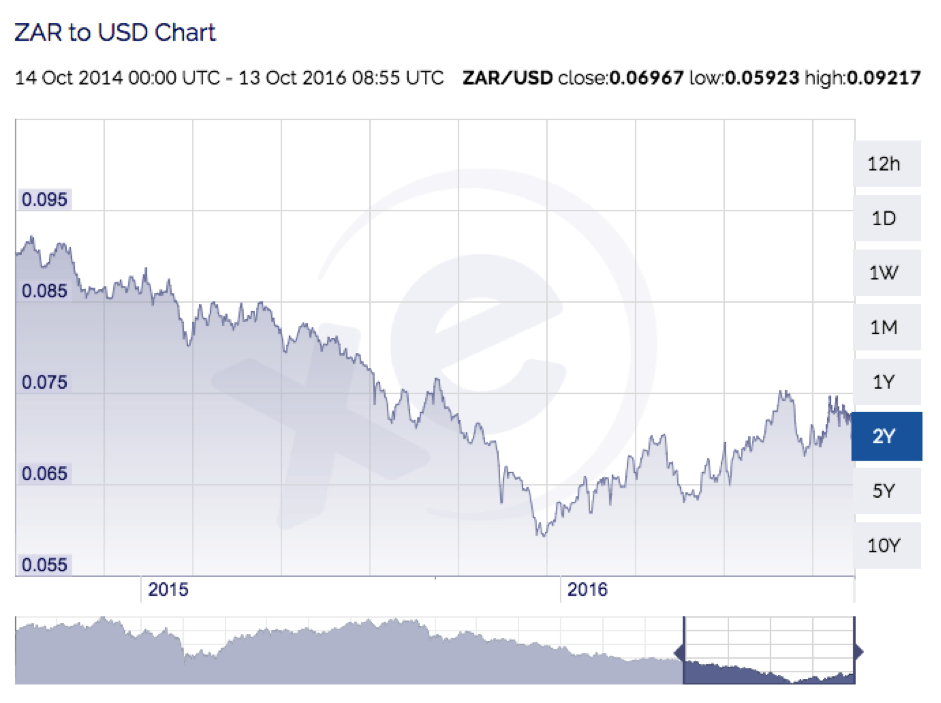

Yachties are used to getting salaries and tips in a currency different to their home currency. When your ‘work’ currency and ‘home’ currencies are stable this doesn’t present many problems, aside from the standard bank fees. A nice steady exchange rate makes it easy to plan both savings and investments. However, when the ZAR is unstable this makes things more complicated.

What is the impact of an unstable currency?

An unstable currency means that you are at the mercy of the market. This is not a fun place to be as:

- You can lose value on transfers

- It can impact how much you ‘take home’ each month

- Planning a savings schedule can be tough

- Core purchases increase in real cost

So what can you do?

Because the currency is unstable you will want to counter balance this with as much stability as possible. This means taking control of as many key factors impacting the value your money as you can.

Get the right Bank Account

This is the most important step.

Make sure that you have a bank account where your salary is paid into an account in the same currency. This means that you then have the control of when you exchange and transfer your money. Rather than being at the mercy of the market the day that your salary drops in.

Getting a Standard Bank Account will help you manage your money. The Seafarers Account offers a selection of most major currencies and also has one of the lowest deposits required. An alternative to the Standard Bank Account is the Lloyds International Bank Account but this generally has higher fees.

Lock in an Exchange rate tariff

You can buy a bulk sum of currency at a certain rate. If you are going to be saving in Rand regularly, perhaps you have property or a business investment; you can lock in a good rate. This can be a fixed sum and the larger the sum that you agree to transfer with them the better the rate you should see.

Providers like IIFX offer this service. Locking in an exchange rate is particularly useful when purchasing a property or business. As the completion process can be a number of months, you don’t want to get caught by a sudden currency change meaning that the investment is no longer affordable.

Minimise Transfer fees

You don’t have to pay the fees to your bank. There are multiple online services such as IIFX that consistently beat the banks for both fees and exchange rates. You can use your bank to provide one service and another provider that specialises in transfers.

Invest in commodities

Another option is to stay away from currencies and exchange rates. If you are being paid in € or $ then you could invest directly in commodities. When you invest in commodities you avoid the market instability. When you decide to sell you can then decide on your preferred currency based on the market at the time.

Watch the rate

It is really easy to lose track of what is high, low and average when there is a constant fluctuation. Fortunately, there are a number of tools that do this for you:

Xe.com lets you select your currencies and track their performance. This is great when you are deciding to make a large transfer or want to lock in an exchange rate with a provider. They also offer an alert tool which will let you know your currency is at your preferred exchange rate.

Getting alerts is ideal, especially when you are about to make a large value transfer, like for a house deposit. If you sign up with IFX they will watch the market for you.

The best way forward

Is to take control. This is sometimes in the form of opening a Standard Bank account and at other times taking a closer look at your long-term financial objectives. The most important thing is to think about what you want from your money and your life:

- Is it flexible access to your cash?

- Is it long-term growth on your investment?

- It is for a SA based investment?

- Do you plan on living elsewhere?

- What currency do you spend the most in?

Answering these questions will help you to work out the best option for the ones selected above. If you have any questions relating to the points above then our team will be happy to help you out.