14th Dec 2023

Your Financial Resolutions Roadmap

As the year draws to a close, it’s time to set your focus towards new financial horizons. However, before you plot your course for 2024, it’s essential to reflect on the past. What worked, what didn’t, and why?

Remember, to get different results, you must make different choices.

Financial Report Card

There is only one person in charge of your personal financial situation, and that is you. If you are running (managing) yourself, you are therefore your own Chief Financial Officer responsible for your financial life. Start with your own financial report card – your personal “Net Worth”. This is the value of what you own minus what you owe. It’s a snapshot of your current financial position. Take a moment to assess what’s working and what isn’t.

Review your earnings, including salary, tips, and any additional income. Categorise and analyse your expenses, covering living costs, provisions, personal expenditures, insurances, and your savings or investment plans. Ensure taxes are filed and paid appropriately. Did your income increase this year? Have your expenses remained steady, or have they fluctuated?

50/30/20

Next, allocate your expenses into needs, wants, and savings, following the 50/30/20 rule. Allocate up to 50% of your income to essential needs and obligations. The remaining half should be divided: 20% for savings and debt repayment, and 30% for discretionary spending. This rule provides a solid foundation for creating a sustainable budget tailored to your financial objectives.

visualise your goals

As you look ahead to the next year, reassess your budget. Could you downsize on expenses, such as car-related costs, and redirect those funds towards meaningful goals, like saving for a property or furthering your education? Perhaps a career change or additional training could substantially boost your earnings. Additionally, consider the country and location you are living in or planning to live in. If you’re earning well but living in a costly country or area, exploring opportunities in more affordable regions might be worth considering.

While considering a move may not be immediate, it’s a factor to keep in mind, especially in relation to your retirement plans. Even though 2024 is on the horizon, envisioning your retirement age and the funds you’ll need is integral to your financial journey.

compounding interest

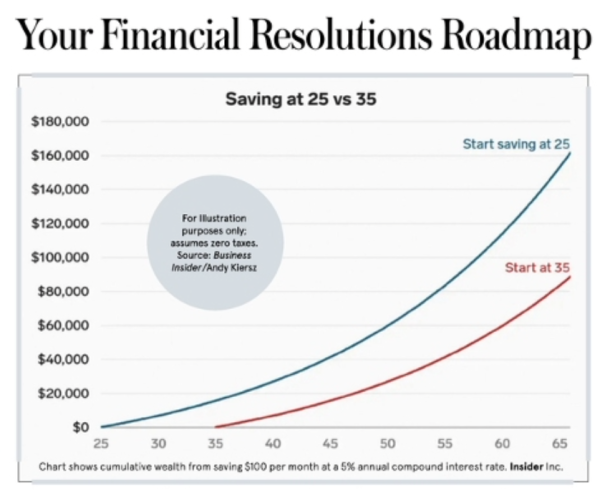

Remember, starting to save early, even with smaller contributions, is more impactful than saving more later due to the power of compounding interest. For instance, beginning at 25 with consistent annual contributions, you can outpace someone who starts later, contributing double the amount. Time is a valuable ally when it comes to growing your wealth.

Plan Ahead

While these pointers serve as valuable starting points, every individual’s financial journey is unique. Factors such as personal goals, career trajectory, lifestyle choices, and risk tolerance, all play a significant role in shaping one’s financial strategy. So, remember, while this guidance provides a solid foundation, crafting a financial plan requires careful consideration of your own circumstances and aspirations and perhaps assistance from someone who can help you with the creation of the plan.

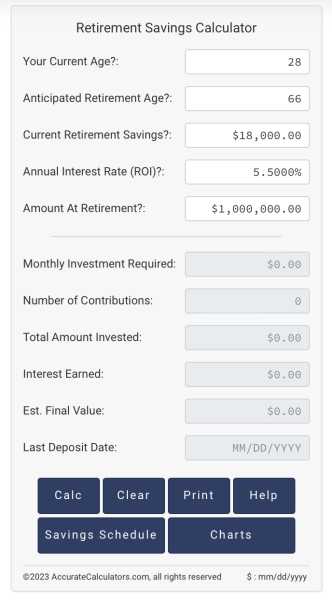

Use our online Retirement Savings Calculator online for a closer look at what you can do now for your retirement

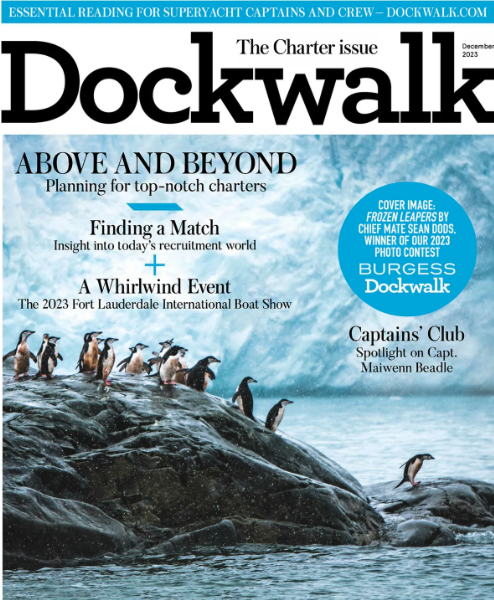

This article appeared in the Dockwalk December 2023 issue.

This communication is for informational purposes only and is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice from a professional adviser before embarking on any financial planning activity.