26th Aug 2019

Is property the best investment?

We ran a poll asking Superyacht crew what they did with their savings. 40% of you, at the time of writing this, are investing in property. Property is always touted as one of the best investments you can make. Everyone has a story about a friend/cousin/neighbour that bought a house for €27,000 and sold it for €230,000 10 years later.

But is property the best investment you can make?

Property has the fact that it is a physical entity in its favour. We can walk in and touch our investment. We cannot all be all experts in finance as we are busy being experts in our own field of work. The world of bonds, gilts and portfolios make many of us walk away without truly understanding their value. This is because, unfortunately, those giving financial advice will often talk in terms that the majority of people don’t understand.

We all understand property and there are many positive societal associations with being a homeowner. There are countries where being a property owner is seen as having made it, and is an aspirational goal, such as in the UK and US. Germany and Switzerland, however, are countries full of renters where this aspiration isn’t so strong.

What are the benefits of investing in property?

In a world of constant change and uncertainty, there is a certain comfort in knowing that you are a homeowner. Also, interest rates are at a historic low, so for countries like France where you get a fixed rate mortgage for 20 years, it seems crazy not to buy.

Germany is a nation of renters but there isn’t a huge amount of security if you are in a popular area. This can mean that you lose your property and that in such a dynamic rental market that you will struggle to find a new one. Being a property owner gives you security, which is perfect when you have a family.

Property is generally a low-risk investment. There is always the challenge of the changing market dynamics and value of an area. But generally over 20 years, property offers a secure and stable return. Finally, you do actually get something physical in return for your investment. This is why the emotional connection is so strong.

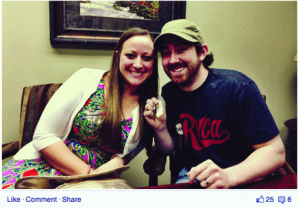

You don’t see Facebook posts of someone about to login to their first portfolio investment in the same way that you see this:

What are risks?

Most of us understand the tangible benefits of owning property but in terms of an investment strategy, there are some downsides. According to Robert Shiller from Yale, historically speaking, your deposit isn’t an investment. In his book Irrational Exuberance, when inflation was taken into consideration, housing returned only 0.4% between 1890-2004. We are currently in a boom where many people are rewarded with quick returns. But most people are buying with a view to selling long-term or upgrading to a bigger property. On balance, it is reasonable to expect that, in the US at least, housing might only return 0.4%.

A similar story can be found in the UK. Colin Beveridge, Chief Investment Officer at True Potential says in This is Money that ‘UK equities produce a higher total compound return compared to cash a property’. He does highlight that the outcome on an annual basis is more prone to variation. Again this all comes down to how long your property investment is for.

Financial Advisers will generally guide clients towards a diversified portfolio. Buying a property will normally use up the bulk of your savings. The challenge around property is even when we can afford to start investing money elsewhere such as bonds and investment portfolios, we tend to just invest again in property. Either through an upgrade or and extension. Putting all your eggs in one basket always carries a risk.

Large cash requirements

Property, on average, is one of the largest cash investments that people make. It generally means that your savings are tied up in one large physical asset. If you have a regular income and no desire to move location in the long-term then this isn’t a problem. However, if you need to sell to get your liquidity back and the market is currently at a low, you could find yourself in a financial pickle.

There is also a lot of conflicting market advice when it comes to property. For example, Auckland is touted as one the hottest areas to invest in with the average house price now over $1m according to The Guardian. However, Radio NZ warns that this rise is only going to continue until Dec 2017, when the market is due to topple by as much as 11%.

In South Africa property has traditionally performed well given the instability of other microeconomic factors. However, there currently seems to be a slow down with the year-on-year rate of increase on prices reaching a lowly 2.1% in the third quarter of 2016 in Gauteng. John Loos, household and property sector strategist at FNB says, “the national average house price growth will be weaker as the weaker economy catches up with the housing market”

What about the maths?

This should be the key part in any financial decision; calculating how much an investment is really going to cost. Most of us look at the cost of a mortgage versus rent. We quite rightly weight up that we’d rather spend €1000 p/m on buying our own house rather than lining a landlords pockets each month.

There are all the other costs to take into consideration:

• Interest rates

• Inflation

• Insurance

• Repair costs

• Stability of the property market

• Stamp duty/ inheritance tax/ capital gains

• Agency fees (for renting or selling)

These costs will also depend on how you intend to use your property. If you are buying a home then there are many other benefits such as security for your family. But if you are buying on a purely financial basis, be it to live in, or to rent. It is worth spending some time doing the calculations before you make what is likely to be your biggest lifetime purchase. Unless you buy a yacht!

Ramit, from I will teach you how to be rich explains how to run these calculations:

Is property the best investment you can make?

Here at United Advisers Marine, we help you to weigh up your options to ensure you are making the right decision for yourself and your family. Speak to one of our team today.