28th Feb 2020

20 reasons to save now!

Sometimes we all need a little nudge when it comes to saving our hard-earned money. It’s often too easy to spend up a storm, especially if our salaries are comfortable enough to enjoy the finer things in life. However, working in the superyacht industry, with its high wages and reduced living costs while onboard, provides the perfect opportunity to save.

There are so many old sayings when it comes to money and savings, like ‘a penny saved is a penny earned’ or ‘take care of the pennies and the dollars take care of themselves’. So, in keeping with our 2020 theme, we’ve come up with 20 reasons to save now:

Sooner is always better

Think about the difference between starting to save €400 per month at age 25 compared with starting to save the same amount at age 35. If you do the basic math without taking into account interests on savings, you could put away an extra €48,000 over 10 years (€400/month x 120 months).

The graph below shows the difference in required contributions for a €1 million retirement fund:

choice

You have the financial freedom to choose. Your savings potential depends on your personal circumstances, but one thing is for sure: everyone loves the idea of being free to make choices without worrying about the financial impact of those choices.

There is never a ‘right’ time

The sooner you start to develop a habit of saving, the better your savings potential over the long-term. There is always something going on stopping us saving:

As we’ve said, the best time is now. Even the smallest amounts can make a difference over time and it is easier to start earlier and make it one of your money habits.

You don’t know what the future holds

You never know whether you’re going to need a safety net in case of an emergency, or you decide to change direction in life. Perhaps you will leave the yachting industry and set up life back onshore. Saving now is the only way to help meet the unexpected.

The global stock market is in a good place

This is despite recent events. The US–China trade war has cooled off, there is some clarity on Brexit and, compared with the previous two years, 2020 looks to be more politically stable. This is good news if your investing in stocks as part of your financial plan.

Update May 2020:

This post was originally published before the COVID-19 crisis. We, like everyone else, hadn’t appreciated the scale of the pandemic when infections first started. The stock market is no longer in the same place and will have changed even by the time we publish this update. That is why we recommend reading about investing during uncertainty. We still believe saving regularly is right for those who want to achieve financial freedom. We can’t predict what the future holds but we do know that having an emergency fund is more important than ever.

Compound interest is powerful

The power of compound interest shows how you can put your money to work and watch it grow. When you earn interest on savings, that interest earns interest on itself and that amount is compounded monthly. Win–win!

Little and often = easier

It’s easier to save sooner and longer rather than large sums later in life. If you choose to reduce your working hours later in life, even retire early, your savings potential will naturally be much lower than when you’re working full-time. It just makes good financial sense to start your savings journey earlier and keep it going for longer.

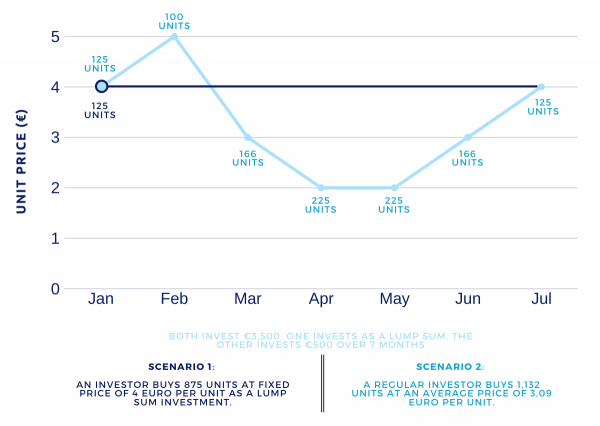

Euro averaging works in your favour

While there’s no such thing as a risk-free investment, you can minimise that risk by pound/euro averaging, which means making regular investments over time rather than a one-off lump sum investment. Because of the mechanics, you end up buying more shares when the price is lower and fewer shares when the price is higher. You accumulate assets without having to ‘time’ the market.

job Flexibility

You aren’t locked into a job. We all want the financial freedom to make choices about when we leave our jobs, right? The sooner you commit to a regular savings plan, the more of a safety net you will have should you wish to pursue another job within yachting or even outside the industry.

freedom to go it alone

You can leave yachting to start your own business. Do you have dreams of starting a business when you get back to shore? If so, it’s pretty likely you’re going to need some money behind you for the start-up costs especially if you plan to open a bricks-and-mortar type business.

Property power

You can buy property sooner and generate revenue from renting. Property is generally a low-risk investment and you can always buy with the intention to rent. Perhaps one of the biggest benefits to owning rental property is that it’s a passive source of income and another source of saving. You can read more about investing in property in our blog Things you should know about buying property.

travel opportunities

You can travel the world. The world’s a big place and there’s lot to see, so if you’re keen to get out there start a dedicated travel savings plan. Although we do also recommend you keep some of your savings in other funds and investments for all the normal rainy-day scenarios.

ditching debt

Debt makes accumulating wealth more difficult, so the sooner you pay off debt the sooner you can funnel that additional money straight into savings or investments. Consider using any salary increases or end-of-season bonuses to pay off debt and then build your ‘wealth snowball’.

retirement security

It’s not wise to rely only on your pension when it comes to retirement. By putting aside regular amounts of money now, you can amass your own form of pension-like savings to enjoy later in life without making too many sacrifices to your lifestyle.

career development

You can upskill yourself for a better position. Your employer may not always be willing to fund your continuing education, so why not put together a dedicated savings plan to fund ongoing skills training and development.

easy increases

You won’t miss the salary increases you’ve become accustomed to while in yachting if you make the decision now to put part of your salary away every month. And why not aim to put as much as 20% of your crew salary into savings every month?

retire young

You could become financially independent much sooner and even retire young. While not everyone’s retirement goals are the same and $1 million doesn’t stretch as far as it once did, if you’re only in your early 20s and saving on a regular basis, you could be looking at retiring in your 50s or even younger.

avoid lifestyle inflation

We know it’s tempting to spend more when you earn more but ‘lifestyle inflation’ can make it difficult to get out of debt, save for retirement or meet other financial goals. We’re not advocating a no-spending lifestyle; just be careful to reward yourself wisely and keep putting some of your hard-eared cash away so that you can live the lifestyle you want now and in the future.

negotiation power

Having wealth makes it easier to borrow money and negotiate rates. If you maintain a good repayment history and keep your debts to a minimum, you stand a greater chance of borrowing money. And if you can build a good reputation with a lender over time, you will be able to reap the benefits such as negotiating lower interest rates on your loans.

save. Enjoy. REPeat

You can enjoy your savings earlier! This links back to the very first point but it’s important enough to repeat. If you wait until later in life to start saving, you can be guaranteed that you will need to work longer and risk never really being able to enjoy what you do manage to save. So, why wait?

You may not be able to control how much you earn on your savings but the decision of when to start saving is definitely within your control. Sooner is always better than later, so start now. You won’t regret it.

If you are interested in kick starting your savings you can download our free guide written for superyacht crew HERE.