12th May 2021

Why it helps to know your net worth

Like your physical health, your financial health is key to leading a happy life. An increasingly popular way to understand how financially healthy you are is to know your net worth.

It will give you a clear idea of whether you are spending too much, how much you have in savings and whether you’re putting enough away for retirement.

What is net worth?

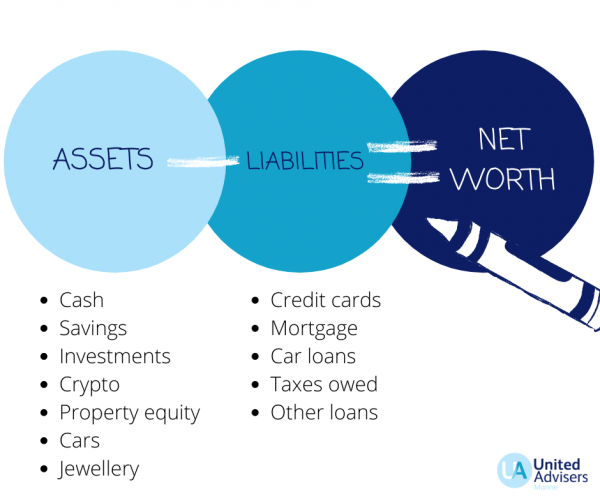

Net worth is simply the value of all your assets (what you own) minus all your liabilities (what you owe). Assets include everything from cash, money in your savings accounts to vehicles and property. Liabilities include any money you owe in the form of loans, credit card debt or mortgages.

In theory, your net worth is the value in cash you would have if you were to sell everything you own and clear your existing debt.

If your assets exceed your liabilities, you have positive net worth. If your liabilities are greater than your assets, you have negative net worth. It is easy to see that a higher positive net worth is preferable to a negative one.

Why net worth is important

Many people don’t take the time to calculate it yet there are many good reasons for doing so:

- Understand your progress over time. Net worth is a specific figure you can track accurately.

- It is an accurate measure of wealth and moves the focus away from income alone. It takes into account expenses and taxes.

- Removal of the over-emphasis on asset value as the sole measure of wealth. If you have €200,000 in assets yet €150,000 in debt, the difference between the two is more important than the value of your assets.

- Keeps debt in perspective. If you have €50,000 in debt yet €200,000 in assets, your debt level isn’t extreme.

- It helps when you apply for a loan. Lenders want to know your overall financial health before they will give their approval.

Be in control

If you track your net worth over time, it will show whether you are making progress toward your financial goals.

Perhaps you want to start a business or buy property when you are back on shore. To help ensure you’re on track to saving enough, it helps to know and understand your net worth.

Knowing, tracking and regularly reviewing your net worth will allow you to be more mindful of your spending and put you in control of making sound financial decisions.

Keep in mind, however, that there’s no ‘magic number’ when it comes to net worth. No two people are striving for exactly the same thing. Your net worth and your financial goals are just that: yours and yours alone. Just because someone you know has a greater net worth, that doesn’t necessarily mean they are happier nor more successful.

How to calculate your net worth

Calculating your net worth is quite simple:

- Add up the total value of all your assets.

- Add up the total value of all your liabilities.

- Subtract your total liabilities from your total assets.

For most of your assets and liabilities, it’s easy to determine the value of each. For example, if you have €15,000 in savings, it’s clear that the value of that asset is €15,000. If you owe €10,000 in loans or on a credit card, the value of that liability is €10,000.

Where it becomes more difficult to determine an accurate value is with big-ticket items like property. People have a habit of over-valuing their own homes or investment properties, so subjectively value it much higher than what the market says it’s worth.

Inflating the value of any asset may look good but it’s not smart because it won’t paint an accurate picture of your net worth. It’s essential to work with either a real estate agent or property appraiser to know the value of any property you own.

Negative isn’t ‘bad’

If you currently owe more than you own, don’t take it as a sign of failure or inability to manage your money. We understand some of you are just starting out in your first job in yachting and are finding your feet when it comes to managing your finances.

Your net worth, positive or negative, is useful data. It’s information for you to work with and base decisions on. If you review it on an annual basis, you can determine if you are making progress towards meeting your goals or if you’re falling behind.

Adjust your spending

A key advantage of knowing your net worth is knowing how much extra money you could put towards things like your emergency fund, pensions and retirement savings.

In our Superyacht Crew Financial Wellbeing Survey, we learned that very few crew members are holding high levels of debt, which is a positive. However, we also learned that not having enough money for retirement is a top concern amongst those surveyed.

In fact, only 6% of respondents receive employer contributions to their personal pensions. When compared with shore-based industries, that figure is alarmingly low and it’s not surprising a lot of crew worry about their financial future.

If you don’t receive employer contributions, you will want an accurate picture of your net worth. You can then work out where to adjust your spending to ensure you put away regular amounts towards a pension or other retirement savings plan.

understand your future

For an up-to-date picture of your net worth, you will need to calculate it on a regular basis.

You could use a simple spreadsheet in which you add all your assets and liabilities and follow the basic formula we outlined above. Alternatively, there are apps that will calculate and track it for you. Some of the most popular options are Personal Capital and Mint.

But how can you get an idea of what your net worth may be in the future? The best option is to work with a financial planner. They can take all of your financial information (assets and liabilities as well as income and expenses) and use cash flow modelling software to produce a detailed statement.

This is one of the first steps in the Financial Planning process. As part of this process, your financial adviser can run multiple scenarios of your possible future based on your current and projected situation.

Cash flow modelling helps you visualise your financial future with easy-to-understand charts and graphs. Using computer modelling, your financial adviser can test the potential impact of life-changing events on your lifelong cash-flow forecast.

Need help?

If you’re short on time to fully review your assets and liabilities and accurately calculate your net worth, a financial planner can help. Get in touch with one of our advisers today.