17th Sep 2019

The Superyacht industry needs to talk about crew pensions

Long hours, hard work, extended periods away from home, significantly higher pay than many other industries. All familiar hallmarks of working on a superyacht, but making the most of those generous earnings frequently isn’t.

Some money-conscious crew may independently establish a personal pension or investment portfolio for later life. Many more may want to, but don’t know how to. Others feel they don’t have options available to them because their yacht doesn’t offer crew pension arrangements as part of their employment package.

In comparison with onshore roles, where pensions funded by employer and employee contributions are relatively standard, the superyacht industry is markedly behind with pension provisions for yacht crew.

Recent research into the welfare of superyacht crew by the International Seafarers’ Welfare & Assistance Network (ISWAN) showed that 77% of respondents (crew and captains) do not receive payments towards a public or private pension scheme from their employer.

Why is the Superyacht industry so behind?

Although there are undoubtedly several factors affecting pension provision to yacht crew, including an employer’s unwillingness to talk about potential additional costs, the issue may, in the end, come down to a mismatch of perceptions around the importance of pensions.

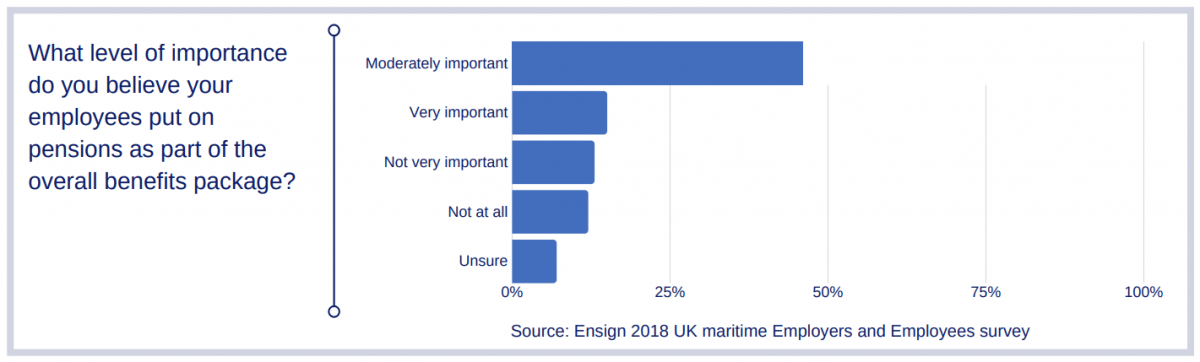

A 2018 survey of UK maritime employers and employees by Ensign, a specialist pension provider to the marine sector, showed that maritime employers grossly underestimate the importance seafarers place on retirement savings and workplace pensions.

The research shows that over half of employers surveyed regard pensions as a ‘not very’ or ‘moderately’ important part of their overall employee benefits package.

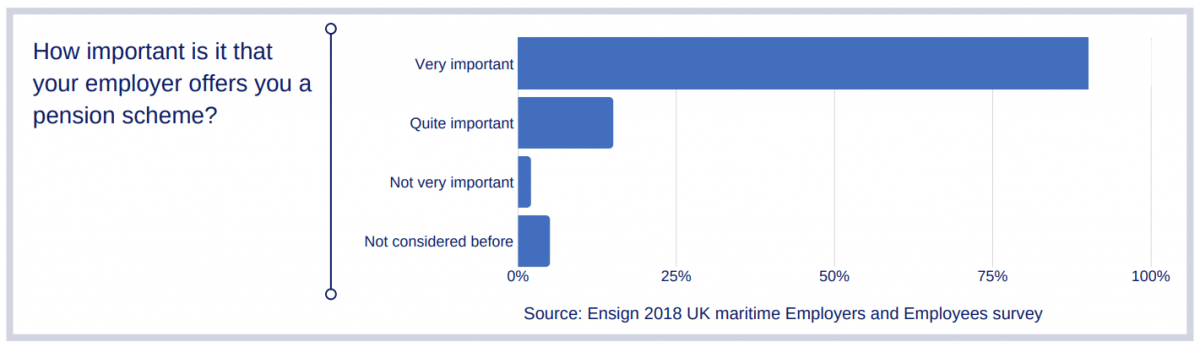

Conversely, asking maritime employees the same question reveals an entirely opposite perception, with four in every five employees regarding pensions as ‘very’ important.

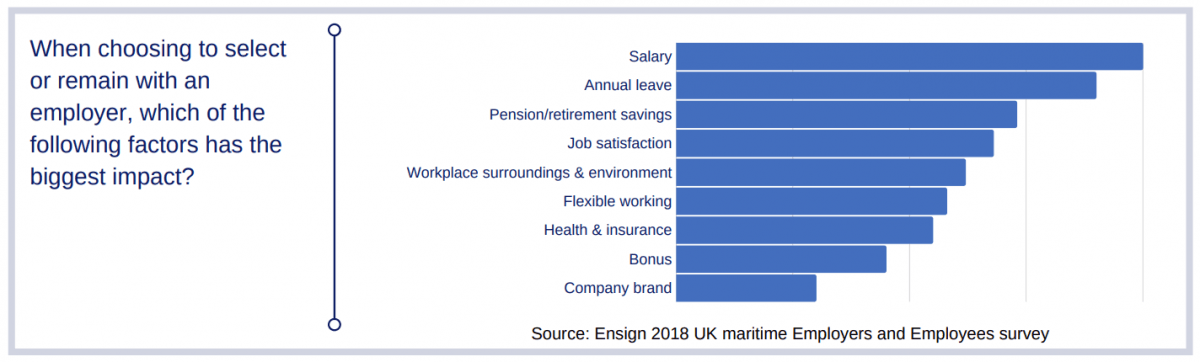

Moreover, when an employee is considering staying in, or changing contracts, whether the yacht includes a retirement or pension savings scheme within the employment package is, conversely to what most employers think, surprisingly high on the list for crew.

When asked to rank factors affecting recruitment and retention, maritime employers only ranked pensions in sixth place behind things like flexible working and workplace surroundings.

This disconnect between what employees actually want and what employers think they want is troubling.

Maritime employers regularly place staff recruitment and retention of staff ahead of political and regulatory developments and globalisation as their single biggest HR challenge, so logic indicates that it behoves employers to attach more importance, perhaps, to what crew actually want, rather than what they think they want; and giving more importance, therefore, to pension provision.

An Opportunity for Employers

Ensign CEO Andrew Waring nails the message to employers in their report with:

‘The message from these findings is clear: employers who downplay the importance of pensions risk losing out in the battle for talent.’

The Ensign report goes on to give a wake-up call to the maritime industry:

“Continuing in this vein could mean employers do not promote the importance of pension provision enough and miss out on a significant retention and attraction tool for the best talent in a competitive market.”

More alarmingly, from a crew perspective, what is essentially ‘Free money’ gained by saving into a pension fund by tax relief earned on pensions contributions is undervalued because most crew are unaware of it.

41% of those surveyed were not aware of the tax relief on pension contributions

The research also found that a lack of understanding means crew are more likely to put spare cash into a bank or building society, rather than use it to top up their pension.

50% did not know how much money they need to have a good retirement income.

As well as significantly affecting when they can retire, this ‘alarming’ lack of understanding about pension rights means seafarers could face a retirement of significant hardship.

Without proper planning and adequate saving, it will become harder for maritime employees to retire when they want to.

Ensign chairman Rory Murphy, speaking about the lack of awareness about tax advantages of pension saving and how much crew need to save, commented:

“…This is a toxic cocktail which could lead to poverty in retirement for thousands of workers, and as such is a critical issue for our industry.

Doing nothing is not an option.”

Waring added:

“This research represents a wake-up call for employers in the shipping and maritime sector. It illustrates an alarming disparity between the industry’s employers and their workers in their attitudes to retirement provision, with employers worryingly slow to recognise the importance of pensions to their staff.”

The Ensign report goes on to stress the

“…crucial role for employers to help build financial awareness amongst staff to allow them to make the most of the scheme provided, understand the elements within their control and plan for their future”.

What happens next?

There is a need for maritime employers to improve the package they offer, especially for young professionals, to ensure they recruit and retain the skilled personnel they need.

There is also a need for employers to play a role in educating crew about their pension rights and opportunities, and for crew to ensure they adequately fund their future retirements.

Crew have a responsibility to make sure their lifestyles are funded into retirement by checking contracts to see what is included, taking control by starting to save and, above all, starting a conversation about pensions.

We want to keep the conversation around pensions and how crew can start discussions as well as taking their future income into their own hands. We run workshops, both onboard and at key Superyacht shows, to educate crew about savings and pensions, as part of this effort.